Owning a home is a significant financial commitment, often considered a cornerstone of the American Dream. However, the path to homeownership can be fraught with unexpected challenges, leaving many homeowners grappling with financial struggles. These struggles can stem from a variety of factors, including job loss, unexpected expenses, medical bills, or simply the weight of mounting debt. While the situation may seem daunting, it’s crucial to remember that overcoming financial difficulties is possible with a proactive approach and a commitment to long-term financial stability.

This article will delve into practical strategies that homeowners can implement to navigate financial challenges and regain control of their financial well-being.

1. Acknowledge the Problem and Seek Professional Guidance

1. Acknowledge the Problem and Seek Professional Guidance

The first step towards overcoming any financial challenge is acknowledging its existence. Denying the problem or burying your head in the sand will only exacerbate the situation. Be honest with yourself about your financial standing and the extent of the difficulties you’re facing.

Once you’ve acknowledged the problem, consider seeking professional guidance from a certified financial planner or credit counselor. These professionals can provide objective insights into your financial situation, develop a personalized plan to address your specific challenges, and offer valuable resources and support.

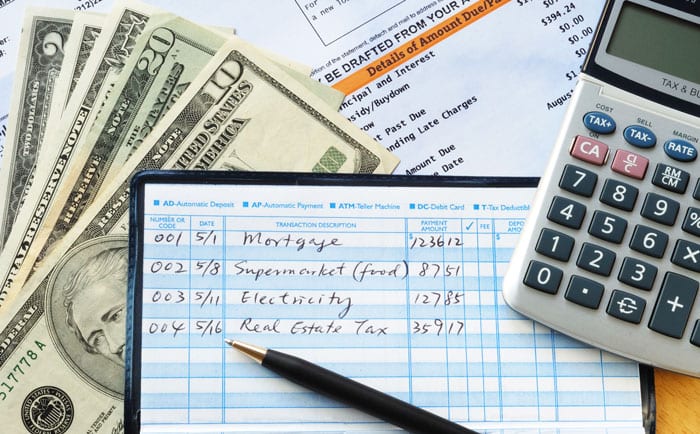

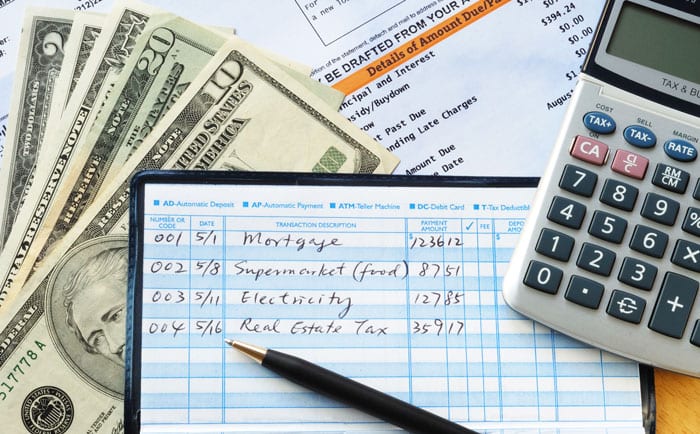

2. Create a Detailed Budget and Track Expenses

2. Create a Detailed Budget and Track Expenses

A detailed budget is the foundation of financial stability. It provides a clear picture of your income and expenses, allowing you to identify areas where you can cut back or make adjustments. Use budgeting apps or spreadsheets to track your spending habits meticulously. This will help you understand where your money is going and identify areas for potential savings.

3. Build an Emergency Fund: A Financial Lifeline

3. Build an Emergency Fund: A Financial Lifeline

An emergency fund serves as a financial lifeline, providing a cushion to absorb unexpected expenses without derailing your financial stability. Aim to save at least three to six months’ worth of living expenses in a readily accessible savings account. This fund can cover unexpected home repairs, medical emergencies, job loss, or other unforeseen circumstances.

4. Explore Refinancing Options: Lowering Your Monthly Payments

4. Explore Refinancing Options: Lowering Your Monthly Payments

If you’re struggling to keep up with mortgage payments, refinancing your loan could provide some relief. Refinancing allows you to secure a new loan with a lower interest rate or a longer repayment term, potentially reducing your monthly payments.

However, it’s crucial to carefully evaluate the terms and conditions of any refinancing offer to ensure it aligns with your long-term financial goals.

5. Cut Unnecessary Expenses: Identifying Areas for Savings

5. Cut Unnecessary Expenses: Identifying Areas for Savings

Take a hard look at your expenses and identify areas where you can cut back. This may involve reducing dining out, canceling subscription services you don’t use, finding more affordable alternatives for everyday purchases, or negotiating lower rates for utilities. Every dollar saved contributes to your financial recovery.

6. Generate Extra Income: Diversifying Your Financial Streams

6. Generate Extra Income: Diversifying Your Financial Streams

Explore ways to generate extra income beyond your primary job. This could involve taking on a side hustle, freelance work, renting out a spare room, or selling items you no longer need. Every additional income stream can help you chip away at debt, build your emergency fund, or achieve other financial goals.

7. Prioritize Debt Repayment: Tackling High-Interest Debts

7. Prioritize Debt Repayment: Tackling High-Interest Debts

High-interest debt can quickly spiral out of control, hindering your financial progress. Prioritize paying down debts with the highest interest rates first, such as credit card debt or payday loans. Consider debt consolidation strategies to simplify your debt management and potentially secure a lower interest rate.

8. Seek Financial Assistance: Leveraging Available Resources

8. Seek Financial Assistance: Leveraging Available Resources

Don’t hesitate to seek assistance if you’re struggling to make ends meet. There are numerous resources available to help homeowners navigate financial challenges. Financial counseling services, government assistance programs, and nonprofit organizations can provide valuable support, guidance, and resources.

9. Stay Positive and Persistent: Maintaining a Long-Term Perspective

9. Stay Positive and Persistent: Maintaining a Long-Term Perspective

Overcoming financial struggles can be a challenging journey, but it’s crucial to maintain a positive outlook and a persistent approach. Celebrate small victories along the way and focus on making consistent progress towards your financial goals. Remember that financial recovery is a marathon, not a sprint, and setbacks are inevitable. Stay committed to your plan, and you will eventually turn the tide in your favor.

Conclusion

Financial struggles can be overwhelming, but they are not insurmountable. By taking a proactive approach, homeowners can overcome these challenges and build a more secure financial future. By acknowledging the problem, creating a budget, building an emergency fund, exploring refinancing options, cutting unnecessary expenses, generating extra income, prioritizing debt repayment, seeking financial assistance, and maintaining a positive mindset, homeowners can turn the tide and regain control of their finances. Remember, it’s never too late to start building a brighter financial future.

For personalized assistance and further guidance on protecting your home investment, visit Gold Homes LLC. Our team is here to help you explore your options and find the best solutions for your situation.

1. Acknowledge the Problem and Seek Professional Guidance

1. Acknowledge the Problem and Seek Professional Guidance 2. Create a Detailed Budget and Track Expenses

2. Create a Detailed Budget and Track Expenses 3. Build an Emergency Fund: A Financial Lifeline

3. Build an Emergency Fund: A Financial Lifeline 4. Explore Refinancing Options: Lowering Your Monthly Payments

4. Explore Refinancing Options: Lowering Your Monthly Payments 5. Cut Unnecessary Expenses: Identifying Areas for Savings

5. Cut Unnecessary Expenses: Identifying Areas for Savings 6. Generate Extra Income: Diversifying Your Financial Streams

6. Generate Extra Income: Diversifying Your Financial Streams 7. Prioritize Debt Repayment: Tackling High-Interest Debts

7. Prioritize Debt Repayment: Tackling High-Interest Debts 8. Seek Financial Assistance: Leveraging Available Resources

8. Seek Financial Assistance: Leveraging Available Resources 9. Stay Positive and Persistent: Maintaining a Long-Term Perspective

9. Stay Positive and Persistent: Maintaining a Long-Term Perspective